Business

X Æ A-XII Musk: The Influence of His Family’s Entrepreneurial Background on His Future

Introduction:

In recent years, X Æ A-XII Musk has become a household name. Being the son of one of the most prominent tech entrepreneurs, Elon Musk, X Æ A-XII Musk has attracted a lot of attention. However, what many people may not know is that X Æ A-XII’s father, Elon Musk, is not the only one in the family with a successful business background. X Æ A-XII’s grandfather, Errol Musk, was also a successful entrepreneur, with a net worth of over $20 million.

Errol Musk’s Business Ventures:

Errol Musk is the father of Elon Musk and the grandfather of X Æ A-XII Musk. He is a successful entrepreneur who made his fortune in South Africa. Errol Musk’s first business venture was a consulting firm called Errol Musk & Associates. The company provided engineering and design services to the mining industry in South Africa. Errol Musk’s business was very successful, and he became a millionaire at a young age.

After selling his consulting firm, Errol Musk started a new venture in the real estate industry. He founded a company called Afriprop, which specialized in developing high-end residential properties. Afriprop became one of the most successful real estate development companies in South Africa, and Errol Musk’s net worth continued to grow.

Errol Musk’s Net Worth:

Errol Musk’s net worth is estimated to be over $20 million. He made his fortune through his successful business ventures in South Africa. Errol Musk’s consulting firm, Errol Musk & Associates, was very successful and helped him become a millionaire at a young age. He then went on to found Afriprop, which became one of the most successful real estate development companies in South Africa.

How X Æ A-XII Musk’s Family Background Shapes His Future:

X Æ A-XII Musk was born into a family of successful entrepreneurs. His father, Elon Musk, is known for his work in SpaceX, Tesla, and PayPal. His grandfather, Errol Musk, also had a successful career in consulting and real estate development. This family background may play a role in shaping X Æ A-XII’s future and career path.

Growing up in a family of successful entrepreneurs may give X Æ A-XII a unique perspective on business and innovation. He may have learned valuable lessons from his father and grandfather about taking risks, pursuing innovative ideas, and overcoming challenges. This could inspire him to become an entrepreneur himself and follow in the footsteps of his family members.

However, X Æ A-XII’s family background may also create high expectations for him. The Musk family is known for their success in business and innovation, and X Æ A-XII may feel pressure to live up to these expectations. This could lead to a stressful and challenging upbringing.

Despite these challenges, X Æ A-XII’s family background could also provide him with unique opportunities. He may have access to resources and connections that could help him succeed in his own career. Additionally, his family’s success could inspire him to pursue ambitious goals and strive for excellence.

X Æ A-XII Musk’s Father’s Business:

Elon Musk is one of the most prominent tech entrepreneurs in the world. He is known for his work in SpaceX, Tesla, and PayPal, among other ventures. Elon Musk’s companies are focused on advancing technology and solving some of the world’s most pressing challenges, such as climate change and space exploration.

SpaceX is a private space exploration company founded by Elon Musk in 2002. The company’s goal is to make space travel accessible to everyone and eventually colonize Mars. SpaceX has achieved several milestones in space exploration, such as launching the first privately funded spacecraft to reach orbit and successfully landing a rocket back on Earth.

Tesla is an electric vehicle and clean energy company founded by Elon Musk in 2003. The company’s mission is to accelerate the world’s transition to sustainable energy. Tesla has revolutionized the automotive industry with its electric cars and is now expanding into other areas, such as solar energy and energy storage.

PayPal is a digital payments company co-founded by Elon Musk in 1998. The company allows people to send and receive money online and has become one of the most popular payment platforms in the world.

Elon Musk’s Net Worth:

Elon Musk’s net worth is estimated to be over $200 billion, making him one of the wealthiest people in the world. He made his fortune through his successful tech companies, such as SpaceX, Tesla, and PayPal. Elon Musk’s innovative ideas and ambitious goals have inspired many people around the world and have led to significant advancements in space exploration, electric vehicles, and clean energy.

Conclusion:

X Æ A-XII Musk comes from a family of successful entrepreneurs and innovators. His father, Elon Musk, is known for his work in SpaceX, Tesla, and PayPal, and has a net worth of over $200 billion. X Æ A-XII’s grandfather, Errol Musk, was also a successful entrepreneur with a net worth of over $20 million.

Growing up in a family of successful entrepreneurs may shape X Æ A-XII’s future and career path, and provide him with unique opportunities. However, it may also create high expectations and challenges for him. Regardless, X Æ A-XII comes from a family with a strong business background and a history of entrepreneurial success.

Business

How to Start a Small Business: A Step-by-Step Guide for Success

Starting a small business can be an exciting venture, but it can also feel overwhelming. Whether you have a brilliant idea for a new product or service or you simply want to be your own boss, there are several important steps to take to turn your dream into a reality. In this comprehensive guide, we’ll walk you through everything you need to know to start and grow a successful small business.

How to Start a Small Business

1. Research and Planning

Identify Your Business Idea

Before diving headfirst into starting a business, take the time to identify your business idea. What product or service do you want to offer? Is there a demand for it in the market? Consider your skills, interests, and expertise to come up with a unique business concept.

Conduct Market Research

Once you have a business idea, conduct thorough market research to validate its potential. Who are your competitors? What is the size of your target market? Understanding your industry and audience will help you make informed decisions and position your business for success.

Develop a Business Plan

A well-thought-out business plan is essential for guiding your small business journey. Outline your business goals, target market, marketing strategy, financial projections, and operational plan in detail. A solid business plan will serve as a roadmap and help you secure funding if needed.

2. Legal and Financial Considerations

Choose a Business Structure

Selecting the right business structure is crucial for legal and tax purposes. Common options include sole proprietorship, partnership, limited liability company (LLC), and corporation. Each structure has its own advantages and disadvantages, so choose the one that best suits your needs.

Register Your Business

Once you’ve chosen a business structure, you’ll need to register your business with the appropriate government authorities. This typically involves filing paperwork and paying registration fees. Make sure to comply with all legal requirements to operate your business legally.

Obtain Necessary Permits and Licenses

Depending on your location and industry, you may need to obtain permits and licenses to legally operate your business. Research the requirements in your area and obtain all necessary permits before launching your business to avoid any legal issues down the road.

Set Up Business Banking

Separating your personal and business finances is essential for managing your finances effectively. Open a business bank account to keep track of your income and expenses, and consider obtaining a business credit card to build credit and manage cash flow.

Understand Tax Obligations

As a business owner, you’ll have various tax obligations to fulfill, including income tax, sales tax, and payroll tax. Familiarize yourself with the tax laws and regulations relevant to your business and consider hiring a tax professional to ensure compliance and maximize deductions.

3. Branding and Marketing

Choose a Memorable Business Name

Your business name is a crucial part of your branding and identity. Choose a name that is memorable, easy to spell, and relevant to your business. Make sure the domain name is available for your website and social media profiles.

Design a Logo and Branding Materials

Invest in professional branding materials, including a logo, business cards, and marketing collateral. Your branding should reflect your business’s personality and resonate with your target audience. Hire a graphic designer if necessary to ensure high-quality visuals.

Create a Marketing Plan

A comprehensive marketing plan will help you attract and retain customers. Identify your target market, choose the right marketing channels (such as social media, email marketing, and advertising), and develop compelling messaging and promotions to reach your audience effectively.

Build an Online Presence

In today’s digital age, having a strong online presence is essential for small businesses. Create a professional website that showcases your products or services, and establish profiles on relevant social media platforms to engage with your audience and promote your brand.

4. Setting Up Operations

Find a Suitable Location

The location of your business can significantly impact its success. Consider factors such as foot traffic, accessibility, and competition when choosing a location. If you’re operating an online business, ensure you have a dedicated workspace that is conducive to productivity.

Purchase Equipment and Supplies

Depending on the nature of your business, you may need to invest in equipment, tools, and supplies to get started. Research suppliers, compare prices, and prioritize quality to ensure you have everything you need to operate efficiently.

Hire Employees (if necessary)

As your business grows, you may need to hire employees to help you manage day-to-day operations. Hire individuals who are qualified, reliable, and share your passion for your business. Consider outsourcing tasks such as accounting or marketing if you don’t have the expertise in-house.

Set Up Accounting and Inventory Systems

Establishing robust accounting and inventory systems is essential for tracking your finances and managing inventory effectively. Invest in accounting software to streamline bookkeeping tasks and implement inventory management tools to avoid stockouts and overstocking.

5. Launch and Growth

Launch Your Business

Once everything is in place, it’s time to launch your business! Promote your launch through various marketing channels, and make sure to deliver exceptional products or services to delight your first customers. Collect feedback and adjust your strategies as needed to improve your business.

Monitor and Adjust Your Plan

The business landscape is constantly evolving, so it’s essential to monitor your progress and adapt your plan accordingly. Keep track of key performance indicators (KPIs), listen to customer feedback, and stay informed about industry trends to stay ahead of the competition.

Seek Funding (if needed)

If you need additional funding to support your business growth, explore your financing options. This could include traditional bank loans, small business grants, crowdfunding, or investment from angel investors or venture capitalists. Prepare a solid business case and financial projections to secure funding.

Expand Your Reach

As your business becomes established, consider opportunities for expansion. This could involve opening additional locations, launching new products or services, or targeting new customer segments. Stay agile and open to new opportunities for growth and innovation.

Conclusion

Starting a small business requires careful planning, dedication, and hard work, but the rewards can be significant. By following the steps outlined in this guide and staying focused on your goals, you can turn your entrepreneurial dreams into reality. Remember to stay flexible, learn from your experiences, and never stop striving for excellence in everything you do. Good luck on your small business journey!

- FAQ: How much money do I need to start a small business?

- Answer: The amount of money needed to start a small business varies depending on the type of business and its scale. Some businesses can be started with just a few hundred dollars, while others may require significant investment in equipment, inventory, or infrastructure. It’s essential to create a detailed business plan to estimate your startup costs accurately.

- FAQ: What is the best business structure for a small business?

- Answer: The best business structure for a small business depends on various factors, including your long-term goals, liability concerns, and tax implications. Common options include sole proprietorship, partnership, limited liability company (LLC), and corporation. Consult with a legal or financial advisor to determine the most suitable structure for your business.

- FAQ: Do I need a business license to start a small business?

- Answer: In most cases, yes, you will need a business license to legally operate a small business. The specific requirements vary depending on your location, industry, and business activities. Research the licensing requirements in your area and obtain all necessary permits before launching your business to ensure compliance with local regulations.

- FAQ: How can I market my small business on a limited budget?

- Answer: There are several cost-effective marketing strategies that small businesses can use to promote their products or services. These include leveraging social media platforms, optimizing your website for search engines (SEO), networking with other businesses and professionals, offering promotions or discounts, and creating compelling content to engage your target audience.

- FAQ: What are some common challenges faced by small business owners?

- Answer: Small business owners often face challenges such as securing funding, managing cash flow, attracting and retaining customers, navigating legal and regulatory requirements, and competing with larger businesses. It’s essential to stay resilient, adapt to changes in the market, and seek support from mentors or industry associations when needed.

Business

How many work hours in a year? 5 advantages you need to know.

1.INTRODUCTION: How many work hours in a year?

Decoding the work calendar:

Ever wondered how many hours you spend at work each year? Let’s uncover the riddle of the annual professional journey.

Crunching the numbers:

A full-time employee works an average of 2,080 hours a year. This figure is based on the usual 40-hour workweek stretched over 52 weeks. However, it is critical to consider variables such as holidays and vacation time.

The Fine Print:

To generate a more realistic estimate, include paid time off, holidays, and additional leave. Adjustments may differ depending on your particular work arrangement.

In conclusion:

Understanding your annual working hours is about more than simply the statistics.

Understanding your time commitment and achieving a healthy work-life balance. Keep these facts in mind as you embark on your career journey.

2.How many work hours in a year: Navigating the Worktime Maze.

Monthly Work Hours Unveiled

Have you ever wondered what the average monthly work hours are? A full-time employee typically works approximately 173.33 hours per month. This statistic is based on the usual 40-hour workweek and provides a picture of your monthly professional commitments.

Quarterly Work Rhythm

Zooming out to a quarterly perspective, the typical work hours in a quarter total around 520 hours. This number represents the three-month cycle, providing a larger snapshot of your work routine with minor variances due to month lengths.

Lifetime Work Chronicles

Over The average person works for approximately 90,000 hours over their lifetime. This comprehensive graphic spans decades and captures the core of a professional journey, underlining the need of making every hour count.

Balancing Act

Understanding these timelines throws insight on the complexities of our work lives, emphasizing the importance of balancing productivity and well-being across different stages of our professional careers.

3.How many work hours in a year: Weekly and Yearly Exploration

Unveiling the weekly workload

Have you ever pondered how many hours you spend at work each week? The typical workweek is 40 hours long. This covers the normal Monday-to-Friday schedule for full-time employees, capturing the essence of our weekly professional engagement.

The Annual Professional Journey

Zooming out to a broader viewpoint, recognizing the annual commitment is vital. In a typical work context, a full-time employee works approximately 2,080 hours each year. This statistic is based on a regular 40-hour workweek spread over 52 weeks, providing insight into the significant time investment we make each year.

Variations and Considerations

Actual work hours may vary depending on employment roles, contractual arrangements, or part-time schedules. Taking these variables into consideration allows for a more sophisticated assessment of individual work responsibilities.

Balancing Act

As we traverse the complexities of our weekly and monthly work schedules, striking a balance between professional efforts and personal well-being becomes increasingly important for a meaningful and lasting professional career.

4.How many work hours in a year: A Complete Guide to Your Annual Commitment

Unveil Your Annual Work Odyssey

Have you ever wondered how many hours you put in each year at work? The solution comes in comprehending your workweek and the subsequent computations that occur.

Workweek Foundation

A typical workweek is 40 hours long, and it serves as the foundation for your professional routine. Understanding the baseline is critical for determining your annual labor commitment.

Non-Work Hours Exploration

On the other hand, it is critical to recognize the value of downtime. Deducting your working hours from the total hours in a year, which is normally 8,760 (24 hours x 365 days), reveals the non-working hours, allowing you to see how much time is left for personal hobbies and relaxation.

5.How many work hours in a year? calculating work hours: Step by Step

1. Identify Your Workweek: Determine your weekly working hours.

2. Multiply by Weeks in a Year: Multiply your weekly hours by 52.

3. If working part-time: adjust the hours accordingly.

Understanding the nuances of your working and non-working hours is critical to living a balanced and fulfilling career and personal life.

6.What Is The Importance Of Knowing: How Many Work Hours In a year?

Unveiling Work Hours: A Key Insight

In today’s fast-paced professional scene, knowing the number of work hours in a year is critical for living a balanced and deliberate life.

Strategic Planning

Understanding the actual figure of your annual work hours enables you to make informed judgments. This understanding establishes the foundation for strategic planning allowing you to set apart time for personal activities, family, and self-care.

Work-Life Harmony

The number of work hours has a direct impact on the delicate balance of professional and personal life. Individuals who are aware of this metric can encourage a harmonious integration of their careers and personal well-being, lowering stress and increasing overall life happiness.

Goal Alignment

Knowing your yearly work hours helps you align your goals with the time commitment required. It acts as a compass, leading people down a purposeful career path while assuring a rewarding and meaningful journey.

YOU ALSO NEED TO VISIT THE FOLLOWING ARTICLES:

Business

Why IUL is a Bad Investment 2024: Unraveling the Complexities

Introduction: Why IUL is a Bad Investment and Understanding Concerns about IUL Investments.

Investing in an Indexed Universal Life (IUL) insurance policy may appear appealing, but there are legitimate issues that need further investigation.

Delving into the Complexities:

Delving into the complexities of IUL exposes a complication that frequently surprises investors. Understanding the subtleties of hidden costs and capped returns is critical for making sound financial decisions.

Recognizing the pitfalls:

Recognizing the possible hazards of IUL is the first step toward financial literacy. Market volatility impact and the illusion of safety are two of the hurdles that individuals must overcome when determining the acceptability of IUL as an investment. This investigation tries to give light on why and For some, IUL may be viewed as a less desirable investment alternative.

Issues with Indexed Universal Life Insurance:

Unpacking Indexed Universal Life Insurance Issues.

When researching insurance choices, it’s critical to be aware of the potential disadvantages of Indexed Universal Life (IUL) insurance.

IUL’s fees and costs are not transparent, which is a major concern. Policyholders frequently struggle to understand the overall financial picture, resulting in unforeseen financial difficulties.

The IUL product can be challenging for some due to its intricacy. Understanding how indexed interest works and the impact of market volatility can be intimidating, so seek professional advice.

Limited investment returns:

While IUL has the ability to Cash value increase often results in restricted returns, preventing policyholders from fully benefiting on market upswings. When contemplating this insurance option, you must compare the limitations against the promised benefits.

B. Addressing IUL Sales Challenges:

Exploring the world of Indexed Universal Life (IUL) insurance exposes a number of obstacles that both agents and buyers encounter during the sales process.

Misaligned incentives pose a substantial challenge in IUL sales. Agents may emphasize fees over their clients’ genuine needs, resulting in the recommendation of policies that are not the greatest fit.

Consumers have a limited understanding

Consumers frequently face the difficulty of insufficient comprehension when it comes to IUL. The intricate nature of the product may be neglected, making it critical for both agents and clients to have in-depth discussions to make an informed selection.

Striking a balance between agent compensation and client education is crucial for addressing the IUL sales challenge. Open communication and a commitment to meeting the client’s financial objectives can result in more successful and gratifying transactions.

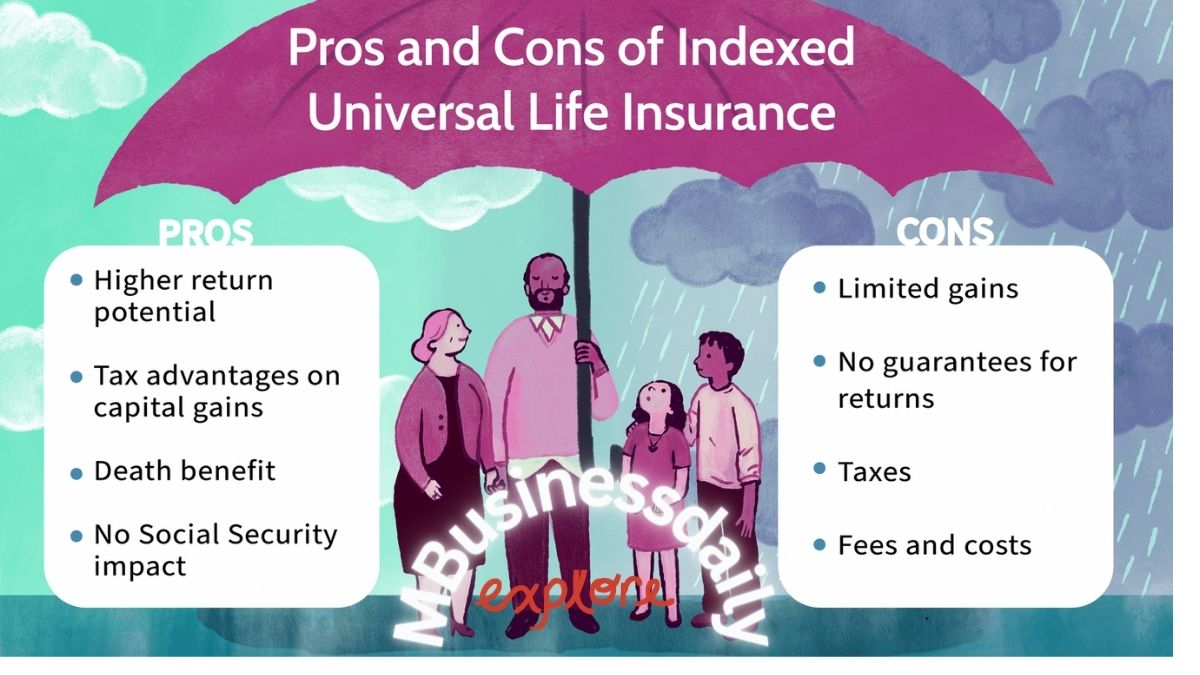

C.The Advantages of Indexed Universal Life Insurance:

Unlocking the benefits of IUL:

Indexed Universal Life (IUL) insurance has several benefits, making it an intriguing option for people wanting both protection and investment potential.

Flexible premiums and Death Benefits:

One significant advantage is the freedom it offers. Policyholders can change premium payments and death benefits to meet their changing financial circumstances, offering a personalized solution to insurance planning.

IUL offers cash value growth linked to market indices, potentially leading to better returns than typical life insurance policies. This feature might be a beneficial supplement to retirement income or other financial objectives.

Downside Protection:

This provision protects policyholders from the full impact of market downturns, providing financial security during economic uncertainty. Understanding and using these benefits can transform Indexed Universal Life into a strategic and effective component of a comprehensive financial plan.

D. Disadvantages of Indexed Universal Life Insurance (IUL):

Indexed Universal Life (IUL) insurance, while beneficial, has several drawbacks that should be carefully considered.

Complexity and lack of transparency:

One notable disadvantage is the intricacy of IUL policies. The complexities of indexed interest and fees can be difficult for policyholders to comprehend, leading to potential misunderstandings.

IUL policies frequently have restrictions on returns, restricting possibility for large development. This can be a disadvantage for those looking for bigger returns on their investments.

IUL premiums can be costly. Policyholders should be aware that the flexibility in premium payments might occasionally result in higher costs, affecting the overall affordability of the coverage. Understanding these downsides is critical for making informed judgments about Indexed Universal Life insurance.

E.Indexed Universal Life Insurance and Other Life Insurance Policies:

Navigating Life Insurance Options:

When comparing lives Understanding the differences between Indexed Universal Life (IUL) and other insurance policies is critical for making an informed selection.

IUL’s Flexibility Over Time and Throughout Life:

One major difference between IUL and standard Term and Whole Life plans is their flexibility. IULs provide for adjustable premiums and death benefits, making it possible to tailor coverage to individual needs.

Investment Potential Versus Guaranteed Benefits:

While IULs give prospective cash value increase based on market indices, Term and Whole Life insurance typically provide assured benefits. The decision between investment potential and guaranteed security is based on personal risk tolerance and financial goals.

Affordability and long-term planning are important considerations. IULs may be appropriate for those seeking a balance of protection and investment. Term and Whole Life plans address distinct financial priorities. Evaluating these criteria ensures that the life insurance policy chosen is in line with the individual’s interests and aims.

F. Is Indexed Universal Life Insurance Suitable for You?

Deciding on the Right Insurance Fit:

When considering life insurance choices, it is critical to determine whether Indexed Universal Life (IUL) is the best fit for your financial needs and objectives.

Assessing risk tolerance:

Consider your risk tolerance. IUL’s potential for market-linked returns may appeal to those who are willing to take some investment risk, but others may prefer the steadiness of guaranteed payouts provided by traditional policies.

Understanding financial objectives:

Understanding your financial objectives is critical. If you want to combine life insurance with potential cash development, an IUL may be right for you. However, if guaranteed benefits and simplicity are important, alternative options may be more appropriate.

Seeking Professional Guidance:

Making insurance decisions can be challenging. Seeking guidance from a financial advisor guarantees a targeted approach, allowing you to make an informed decision that is in line with your specific financial circumstances and goals.

G. Can I sell my IUL?

Exploring Options for Selling IUL Policies:

If you’re thinking about selling your Indexed Universal Life (IUL) insurance policy, you should first grasp the various options and implications.

Evaluate your IUL policy’s surrender alternatives before deciding to sell. Understanding the surrender costs and fees is critical for assessing the financial implications of such a decision.

Secondary Market Considerations:

Exploring the secondary market for life insurance is another option. Some investors may be interested in purchasing your policy, but you must navigate this space cautiously and be mindful that the sale price may be less than the policy’s face value.

Professional Advice:

Selling an IUL policy is complex. Seeking advice from a financial adviser or insurance specialist can help you make an informed selection based on your unique financial circumstances and requirements.

H.What distinguishes the IUL?

Introducing the Unique Features of Indexed Universal Life (IUL):

Indexed Universal Life (IUL) is a different life insurance option with a number of features that set it apart in the financial world.

Customized Flexibility for Policyholders:

One noticeable advantage is the customizable freedom it provides. Policyholders are allowed to adapt. Premiums and death benefits are adjusted to reflect their changing financial conditions and ambitions.

IULs offer the possibility for market-linked growth, unlike standard life insurance. The indexed interest feature enables policyholders to profit from market upswings while providing downside protection during downturns.

Balancing Act for Financial Planning:

IUL stands out for its ability to balance life coverage and investment possibilities. This distinct combination makes it an appealing alternative for people looking for a complete approach to financial planning that can be tailored to their changing circumstances.

I. Understanding Indexed Universal Life (IUL): Basics to Know

Indexed Universal Life (IUL) is a one-of-a-kind life insurance plan that provides life coverage as well as the possibility of cash value increase.

How the IUL Works:

IUL operates by connecting the policy’s cash value growth to the success of specific market indexes, you might potentially earn larger returns than with typical life insurance.

Customizable features:

One important characteristic is its adaptability. Policyholders can customize premium payments and death benefits based on their financial circumstances, providing a more personalized approach to life insurance planning.

IULs are unique in their ability to provide a death benefit to beneficiaries while also operating as an investment vehicle. Understanding this balance is critical for those seeking a holistic approach to both insurance and wealth accumulation.

FAQs: about why Indexed Universal Life (IUL)is considered bad investment?

Conclusion: Understanding Indexed Universal Life (IUL) and Avoiding Pitfalls Why is IUL considered a risky investment?

Understanding the possible drawbacks of Indexed Universal Life IUL is critical for making educated decisions. Policyholders should be aware of the dangers connected with this complicated financial product, which range from the influence of market volatility to hidden charges.

The illusion of safety:

The illusion of safety in IUL emphasizes the need of understanding the complexities of this investment. Recognizing the complexities prevents policyholders from being misled into believing they have financial security.

Hidden Costs & Fees:

It is critical to understand the hidden costs and fees included in IUL plans. Scrutinizing the fine print enables investors to understand the exact cost of their investment and make informed decisions.

Impact of Market Volatility:

IULs rely on market performance, exposing investors to volatility. Understanding this i

nfluence is critical for making sound decisions and avoiding financial losses.

Advantages of indexing Universal Life Insurance :

(IUL) provides variable premiums, potential cash value increase, and protection against market downturns. Recognizing these benefits enables individuals to use IUL as a strategic component of their financial planning.

The disadvantages of Indexed Universal Life Insurance:

The gains are balanced by disadvantages like as policy complexity, return caps, and potentially higher premiums. Evaluating these disadvantages ensures that individuals make well-informed decisions that match with their financial objectives.

Conclusion:

When navigating the world of Indexed Universal Life, individuals must carefully consider the risks and rewards. When examining the benefits, drawbacks, or a sale, it is critical to get competent advice. Understanding the specific features, hazards, and potential rewards of IUL enables a complete

-

Apps7 months ago

Apps7 months agoHow to Send a Snap with the Cartoon Face Lens

-

Entertainment1 year ago

Entertainment1 year agoUfreegames – The Ultimate Gaming Platform

-

News1 year ago

News1 year agoNalco Q3 Profit Drops 69% YoY to Rs 256 Crore: An Analysis

-

Business5 months ago

Business5 months agoDTF Printer: A Game-Changing Solution for Printing

-

Entertainment6 months ago

Entertainment6 months agoDitto Pokemon Go: The Ultimate Guide to Catching this Shape-Shifting Pokemon

-

Accessary11 months ago

Accessary11 months agoCorsair Void Pro RGB Wireless: The Ultimate Gaming Headset for Serious Gamers

-

Celebrity1 year ago

Celebrity1 year agoমিচিয়াকি তাকাহাশি – A Role Model for Success

-

Business1 year ago

Business1 year agoIntroduction to EVE Marketer: A Guide to Thriving in the Virtual Economy